NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, CANADA, AUSTRALIA OR JAPAN OR ANY OTHER JURISDICTION IN VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION

ADVERTISEMENT. This announcement is an advertisement relating to the intention of the Company (as defined below) to proceed with the Offering (as defined below) and the Admission (as defined below). This announcement does not constitute a prospectus. This announcement is for information purposes only and is not intended to constitute, and should not be construed as, an offer to sell or a solicitation of any offer to buy Shares (as defined below) in any jurisdiction, including the United States, Canada, Australia, South Africa or Japan. If and when the Offering is launched, further details about the Offering and the Admission will be included in the Prospectus (as defined below). Once the Prospectus has been approved by the Dutch Authority for the Financial Markets (Stichting Autoriteit Financiële Markten) (the “AFM“), the Prospectus will be published and made available at no cost at the start of the offer period through the corporate website of the Company (https://www.motork.io/), subject to securities law restrictions in certain jurisdictions. An offer to acquire Shares pursuant to the Offering will be made, and any potential investor should make their investment, solely on the basis of information that will be contained in the Prospectus and in particular the “Risk Factor” section. Potential investors should read the Prospectus before making an investment decision in order to fully understand the potential risks and rewards associated with the decision to invest in the Shares. The approval of the Prospectus by the AFM should not be understood as an endorsement of the quality of the Shares and the Company.

PRESS RELEASE

MOTORK LTD. ANNOUNCES ITS INTENTION TO LAUNCH AN INITIAL PUBLIC OFFERING AND LISTING ON EURONEXT AMSTERDAM

London, 14 October 2021 – MotorK Ltd. (to be re-registered as a public company limited by shares under the laws of England and Wales and renamed MotorK plc, together with its subsidiaries and affiliates, “MotorK” or the “Company”), a leading software as a service (“SaaS“) provider to the automotive retail industry in the EMEA region, announces today its intention to launch an offering consisting of a private placement to qualified institutional investors of new ordinary shares (“New Shares”) by the Company and existing ordinary shares by certain shareholders in connection with any over-allotment and to apply for listing and trading of all its ordinary shares (the “Shares”) on Euronext Amsterdam, a regulated market operated by Euronext Amsterdam N.V. (the “Admission”) (the “Offering” and together with the Admission, the “IPO”).

The IPO is expected to take place before the end of 2021, subject to market conditions and receipt of the necessary authorisations from Euronext Amsterdam N.V. and the Dutch Authority for the Financial Markets (Stichting Autoriteit Financiële Markten) (the “AFM”).

Marco Marlia, the Chief Executive Officer and co-founder of the Company, stated that: “We are thrilled to announce our planned IPO, which we believe will unlock massive opportunities for our business, customers, partners, and our people. As a tech company with automotive in our DNA, we have worked tirelessly to build a market-leading platform and a successful growth strategy that combines organic growth with strategic acquisitions. We believe this is just the beginning of our journey and that the runway ahead of us is expansive. We are positioned to accelerate our growth and strongly believe that now is the right time to pursue an IPO, which will help provide the resources to invest in our platform and our team and to support our goal of accelerating the evolution of the automotive industry.”

Company Description

MotorK is a leading SaaS provider for the automotive retail industry in the EMEA region, with over 250 employees, several OEM customers and eight offices in seven countries (Italy, Spain, France, Germany, Portugal, the UK, and Israel).

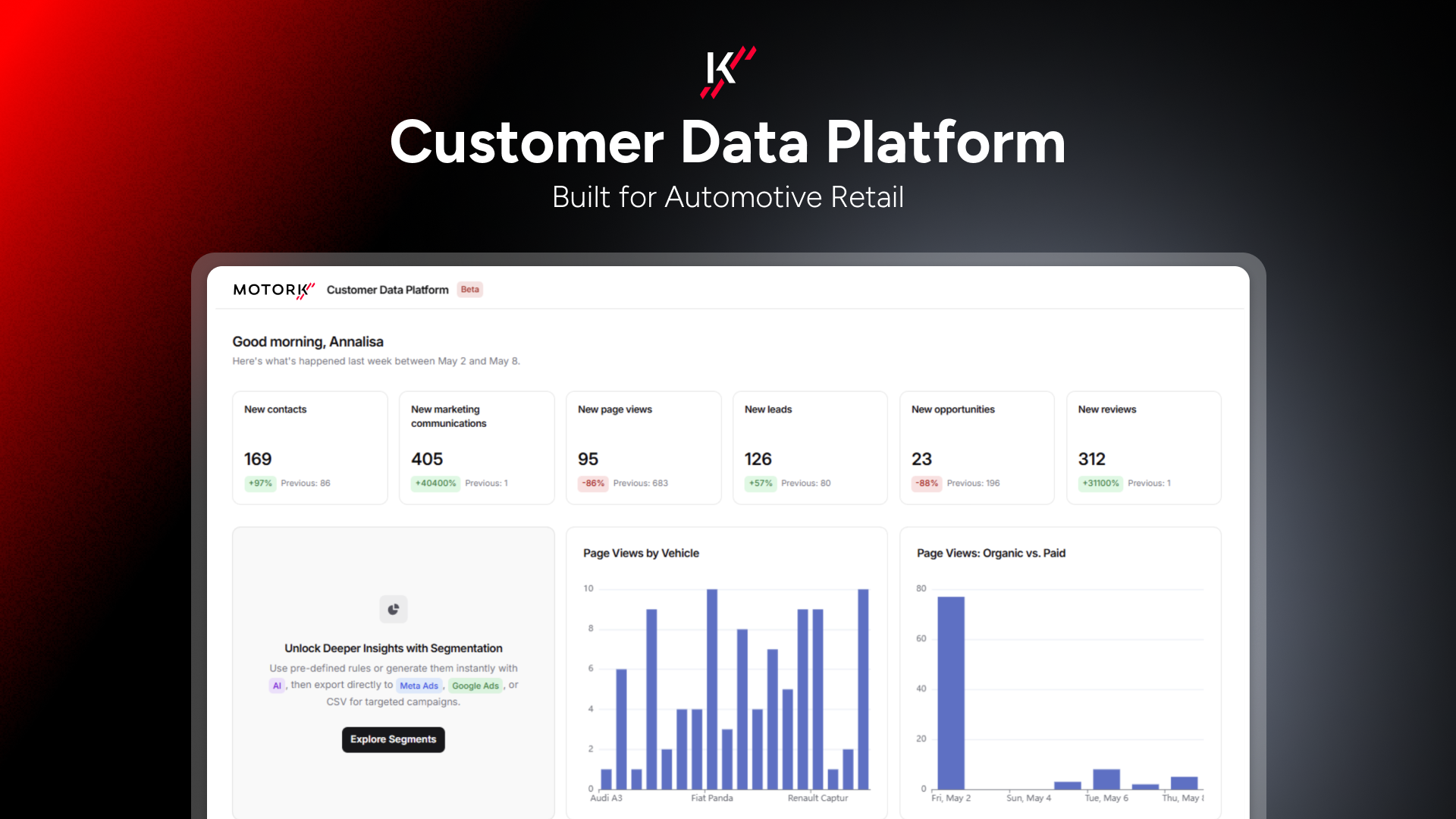

MotorK mainly offers a cloud-based SaaS platform, called “SparK”, spanning a comprehensive suite of products to support the full vehicle lifecycle and the entire customer journey. SparK can be used to manage the digital presence of a small single showroom dealer as well as support the sales and marketing functions of a regional network of franchise dealerships for an automotive OEM across EMEA. As of today, SparK is used by over 660 dealer groups and 13 original equipment manufacturers (“OEMs“) in the EMEA region.

The main modules currently offered by MotorK through SparK are:

- a digital experience website platform to provide automotive retailers with online visibility and improve their lead generation performance,

- a lead management and customer relationship management system to optimize the efficiency of the sales process, and

- a solution to manage the vehicle stock and inventory and import them to online platforms like classifieds, Google, Facebook, etc.

MotorK also offers ancillary services such as online marketing, training and setup services. Part of this service is currently in transition to become part of the SparK platform as a recurring SaaS advertising module called “AdSparK”. AdSpark is targeted to become part of SparK in the first half of 2022.

In 2020, MotorK’s customers managed 1.4 million vehicles through MotorK’s solutions and had over 50 million unique users, considering the sum of unique users on each dealers’ website with active users, i.e., users who have interacted with the platform at least once, in several countries across EMEA. Additionally, during the second quarter of 2021 more than 145,000 cars were sold by dealers using the platform’s CRM Module.

Highlights of the Offering

- The expected Offering will consist, in part, of New Shares with targeted gross proceeds of EUR 150 million (the “Capital Increase”);

- One or more shareholders of the Company are expected to provide a market standard over-allotment option in the size of up to 15% on top of the New Shares;

- In the context of the Offering and based on the indicated envisaged offering size, one or more funds or accounts managed by Capital International Investors (the “Pre-Committed Investor”) have committed to subscribe for freely tradable New Shares at the final offer price for an amount of EUR 30 million, subject to customary conditions, in exchange for a guaranteed allocation;

- It is envisaged that the free float required for the purposes of the Admission will be achieved through private placements of the New Shares;

- The Company and shareholders of the Company are expected to agree to lock-up undertakings of 180 days and 360 days, respectively;

- The Offering is expected to comprise a private placement to certain qualified institutional investors only in the Netherlands and various other jurisdictions;

- MotorK has appointed Joh. Berenberg, Gossler & Co. KG to act as sole global coordinator and together with ABN AMRO Bank N.V. (in cooperation with ODDO BHF SCA) as joint bookrunners for the Offering;

- The IPO remains subject to market conditions and receipt of the necessary authorisations from Euronext Amsterdam N.V. and the AFM;

- If and when the IPO is launched, additional details will be included in the prospectus relating to the Offering and the Admission on Euronext Amsterdam. Once the prospectus is approved by the AFM, the Prospectus will be published and made available at the start of the offering period through the website of MotorK (www.motork.io), subject to securities law restrictions in certain jurisdictions.

Use of Proceeds

The proceeds from the Offering relating to the sale of New Shares will be used to increase R&D spending, invest in sales and marketing, support the acquisition strategy of MotorK, and reimburse the European Investment Bank under the terms of a facility agreement. More specifically, the Company intends to use approximately 20% of such proceeds in R&D spending to strengthen its existing product suite and accelerate new product development; with another 20% intended to support the expansion of the Company’s sales teams to accelerate new customer wins and expand its existing customer base. The Company expects the remaining 60% of such proceeds to be allocated to M&A activities, as the Company is looking to leverage its position as a leading player to further consolidate a fragmented market in order to gain market share and continue to enter new geographies.

Investment Highlights

Key Strengths

Well positioned relative to its key competitors to benefit from structural growth in a large market primed for digital disruption

MotorK estimates that the EMEA automotive distribution software market is a large, underserved market with positive tailwinds. The Company estimates that the total addressable market’s size is approximately €5.4 billion in Europe, supported by long-term trends of reference markets such as the digital ad spending of the automotive industry and global online revenue of vehicle retail. The global automotive retail software market in the EMEA region, where MotorK operates, is highly fragmented.

Offering a first at-scale one-stop-shop SaaS platform for automotive retail

Thanks to its deep knowledge of the automotive industry, MotorK acts as partner of choice for the key automotive brands and dealerships in EMEA through its one-stop-shop SaaS platform. Through its comprehensive suite of modules, the Company’s platform supports customers throughout the entire vehicle life cycle and customer journey with more than 100 automotive-specific features, providing a clear competitive advantage.

Attractive value proposition driven by state-of-the-art technology and product features with substantial benefits

Through its focus on investing in R&D, the Company has developed a highly efficient product suite, as demonstrated by the improvement in the following metrics recorded by customers which have implemented the SaaS platform for the first time, supported by state-of-the-art technology: a 60% improvement in appointment ratio, a 50% increase in click-to-lead conversion rate, and a 120% rise in lead-to-sale conversion.

Highly efficient go-to-market strategy produces a fast-growing and loyal customer base

MotorK has consistently grown its customer base, with the total number of customers more than doubling since 2017. The Company has also demonstrated a strong ability to retain customers, having registered only a 3.6% average churn rate in 2018 and 2019 (before the impact of COVID-19), as well as a track record of continuously increasing customer value, with a 1.4x increase in ARR / customer over 2017 – 2020. Overall, this resulted in a net revenue retention rate of 114% before the impact of COVID-19.

Attractive financial profile combining top-line growth, revenue visibility and strong margin potential

The Company has a track record of rapid growth, having delivered a 46% Sales CAGR over 2016 – 2020. In addition, MotorK has a high level of revenue visibility driven by the subscription-based nature of its SaaS platform and is already EBITDA positive as of H1 2021.

Highly experienced management team with technological expertise and an impressive track record of growing businesses

MotorK is led by its co-founder and a team of highly committed and experienced executives from established digital-led global businesses. Its management team has a proven track record of generating results through developing powerful consumer insights, designing value enhancing products for customers and building scalable global operations, all while preserving the same visionary spirit that drove the business of the Company from the start.

Strategy

MotorK has a clearly defined strategy of pursuing organic and inorganic growth to drive market share gains, expand its customer base and continue its roll-out into new geographies. Specifically, MotorK’s growth strategy is focused on:

- Continuing to focus on innovation to further strengthen the value proposition of MotorK

- Leveraging effective go-to-market strategy to win new customers

- Expanding MotorK’s SaaS offering

- Continuing to grow existing customer base

- Rolling out offering into new markets and geographies

- Building on previous M&A track record to consolidate the market

Risk Factors

The following is a brief description of the most material risk factors specific to the Company. In making the selection, the Company has considered circumstances such as the probability of the risk materialising on the basis of the current state of affairs, the potential impact which the materialisation of the risk could have on the Company’s business, financial condition, results of operations and prospects, and the attention that management would, on the basis of current expectations, have to devote to these risks if they were to materialise:

- The Company’s business and financial performance depends on the development of the automotive distribution market, which is highly sensitive to geo-political and macroeconomic conditions and is subject to a high level of fluctuation.

- The Company’s sales and profitability have been seriously impacted by the macroeconomic downturn resulting from the COVID-19 pandemic and there may be further negative effects if the pandemic continues.

- Global trends affecting the automotive distribution market could lead to reduced demand for the Company’s products and services.

- The Company faces a high level of competition in the markets where it operates.

- The Company may fail to maintain existing customers, attract new customers or sustain its growth rate.

- The Company may fail to successfully complete acquisitions as part of its growth strategy.

- The Company may be unable to successfully complete the intended sale of its DriveK business unit and, even if such sale is successfully completed, the Company may be unable to benefit from efficiencies generated by the sale as anticipated.

- The Company’s research and development resources may not be adequate.

- Certain services that the Company offers to its customers depend on a limited number of third-party providers.

- The Company could suffer losses and be subject to fines or damage claims in the event of any unauthorized disclosures of confidential information and use of personal data in the Company’s products or breaches in the Company’s security or that of third-party service providers.

- The Company may be unable to integrate its digital solutions with third party applications used by customers.

- The Company’s business performance depends on sufficient traffic being generated on its customers’ websites, which is subject to a number of factors outside of the Company’s control.

- The Company’s internal information technology systems, or those of its partners, contractors or consultants, may fail or suffer cyber-attacks, security breaches and system outages and other incidents, which could result in a material disruption of the Company’s product development programs and subsequent losses.

DISCLAIMER

This communication is not being made in and copies of it may not be distributed or sent into the United States, Canada, Australia or Japan or any other jurisdiction in which the making or distribution of the communication would be prohibited or restricted.

This announcement is for information purposes only, does not purport to be full and complete and is not intended to constitute, and should not be construed as, an offer to sell or a solicitation of any offer to buy Securities in any jurisdiction, including the United States, Canada, Australia, South Africa, or Japan. No reliance may be placed by any person for any purpose on the information contained in this announcement or its accuracy, fairness or completeness.

This communication is not an offer of securities for sale in the United States. The securities referred to herein may not be sold in the United States absent registration or an exemption from registration under the U.S. Securities Act of 1933, as amended. MotorK does not intend to register any of the securities in the United States or to conduct a public offering of the securities in the United States. Any public offering of securities will be made by means of a prospectus that may be obtained from the issuer and that will contain detailed information about the issuer and management, as well as financial statements.

This communication is addressed in any member state of the European Economic Area only to those persons who are qualified investors in such member state (“Qualified Investors”) within the meaning of Regulation (EU) 2017/1129 (the “Prospectus Regulation”) and such other persons as this announcement may be addressed on legal grounds, and no person that is not a Qualified Investor may act or rely on this communication or any of its contents.

This communication does not constitute a prospectus within the meaning of the Prospectus Regulation and does not constitute an offer to acquire any securities. Any offer to acquire the securities referred to herein will be made, and any investor should make its investment, solely on the basis of information that will be contained in the prospectus to be made generally available in the Netherlands in connection with such offering. When made generally available, copies of the prospectus may be obtained through the website of MotorK.

No prospectus has been or will be approved in the United Kingdom in respect of the securities referred to herein. This communication is being distributed to and is directed only at persons who are outside the United Kingdom or, if in the United Kingdom, to “qualified investors” within the meaning of Article 2(e) of Regulation (EU) 2017/1129 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 who are: (i) investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”); (ii) are high net worth entities, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order; or (iii) persons that fall within another exemption to the Order (all such persons together being referred to as “Relevant Persons”). Any investment activity to which this communication relates will only be available to and will only be engaged with, Relevant Persons. Any person who is not a Relevant Person should not act or rely on this communication or any of its contents.

Each of Joh. Berenberg, Gossler & Co. KG and ABN AMRO Bank N.V. (together, the “Managers”) is acting exclusively for MotorK and no one else in connection with any offering of securities and will not be responsible to anyone other than MotorK for providing the protections afforded to their respective customers or for providing advice in relation to any offering or any transaction or arrangement referred to herein. Each of the Managers and their respective affiliates expressly disclaim any obligation or undertaking to update, review or revise any forward looking statement contained in this communication whether as a result of new information, future developments or otherwise.

The contents of this communication have been prepared by and are the sole responsibility of MotorK. None of the Managers nor any of their respective subsidiary undertakings, affiliates or any of their respective directors, officers, employees, advisers, agents, alliance partners or any other entity or person accepts any responsibility or liability whatsoever for, or makes any representation, warranty or undertaking, express or implied, as to the truth, accuracy, completeness or fairness of the information or opinions in this document (or whether any information has been omitted from the document) or any other information relating to the group, its subsidiaries or associated companies, whether written, oral or in a visual or electronic form, and howsoever transmitted or made available or for any loss howsoever arising from any use of this document or its contents or otherwise arising in connection therewith. Accordingly, each of the Managers disclaims, to the fullest extent permitted by applicable law, all and any liability, whether arising in tort or contract or that they might otherwise be found to have in respect of this document and/or any such statement.

Information to Distributors

Solely for the purposes of the product governance requirements contained within: (a) MiFID II; (b) Articles 9 and 10 of Commission Delegated Directive (EU) 2017/593 supplementing MiFID II; and (c) local implementing measures (together, the “MiFID II Product Governance Requirements”), and disclaiming all and any liability, whether arising in delict, tort, contract or otherwise, which any “manufacturer” (for the purposes of the MiFID II Product Governance Requirements) may otherwise have with respect thereto, the Shares have been subject to a product approval process, which has determined that the Shares are: (i) compatible with an end target market of retail investors and investors who meet the criteria of professional clients and eligible counterparties, each as defined in MiFID II; and (ii) eligible for distribution through all distribution channels as are permitted by MiFID II (the “Target Market Assessment”). Notwithstanding the Target Market Assessment, “distributors” (for the purposes of the MiFID II Product Governance Requirements) should note that: the price of the Shares may decline and investors could lose all or part of their investment; the Shares offer no guaranteed income and no capital protection; and an investment in the Shares is compatible only with investors who do not need a guaranteed income or capital protection, who (either alone or in conjunction with an appropriate financial or other advisor) are capable of evaluating the merits and risks of such an investment and who have sufficient resources to be able to bear any losses that may result therefrom. The Target Market Assessment is without prejudice to the requirements of any contractual, legal or regulatory selling restrictions in relation to the Offering.

For the avoidance of doubt, the Target Market Assessment does not constitute: (a) an assessment of suitability or appropriateness for the purposes of MiFID II; or (b) a recommendation to any investor or group of investors to invest in, or purchase, or take any other action whatsoever with respect to the Shares.

Each distributor is responsible for undertaking its own Target Market Assessment in respect of the Shares and determining appropriate distribution channels.

Contacts

Media

Camilla Scassellati Sforzolini/ Julia Leeger

Sard Verbinnen & Co (SVC)

MotorK-SVC@sardverb.com

+44 7960 702 664/

+44 7963 380 446

Francesca Prosperi / Madia Reina

francesca.prosperi@motork.io

madia.reina@motork.io

+39 33 5848 9800

+39 371 3771779